(WHITE TOWNSHIP, NJ – March 8, 2023) – The Warren County Commissioners have taken a stand against preferential treatment or discrimination based on environmental, social, and governance (ESG) standards.

ESG is a set of criteria that can alter how certain businesses and governments make decisions, shifting the focus away from traditional considerations like quality of goods and services, performance, finances, and costs to various environmental, social, and governance concerns.

The widespread use of ESG standards by central banks, financial institutions, corporations, and governmental entities poses a threat to free market competition, individual and economic rights, and could impose significant risks to the efficient and cost-effective functioning of Warren County, the commissioners said. Policies that prioritize ESG concerns over traditional economic and financial considerations could lead to substantial increases in costs resulting from expenditure decisions that do not prioritize expense.

“While it may ‘feel good’ to tout that you’ll only invest or do business with companies that have high ESG scores, the scores themselves are unregulated and vary from scorecard service to service,” Commissioner Director Lori Ciesla said, adding “Without uniformity and consistency, the scores can be manipulated, misleading, and misused. There are other measures and methods for us to deem which businesses are sound and responsible, and we will continue to use reliable factors when doing business with others of behalf of the county.”

The Warren County Board of County Commissioners strongly opposes any ESG policy that is implemented without regard to its economic and financial consequences for Warren County residents and businesses. The Board is deeply concerned about the negative effects that ESG could have on the county's residents and businesses.

Commissioner James R. Kern III stated: “We have a fiduciary duty to the taxpayers of this county and our most important function is to handle their hard-earned dollars with the utmost respect. Any policy or preferential treatment that puts ideology above fiscal responsibility is wrong and will have no place here in Warren County.”

“When our pensions and 401Ks decline, and our economy fails because we care more about how a company thinks rather than how it performs, we will have ESG to blame,” Commissioner Jason J. Sarnoski said.

The Commissioners, who adamantly oppose preferential treatment or discrimination based on ESG standards and are committed to maintaining sound fiscal and budget management policies, have passed this resolution to take all necessary action, to the extent authorized by law, to oppose and prohibit the use or implementation of ESG in all matters of County government.

“ESG is an attack on our individual liberties and it will be the death of capitalism in America,” Commissioner Sarnoski said, adding, “It attacks our First and Second Amendment rights and picks favorites in our economy. Starting with big business and now trickling down into our individual lives, I fear a future where every person has an ESG credit score, and if that person’s business or views do not align with what ‘society’ deems correct then their score will be low.”

Sarnoski continued, “ESG could affect an individual’s ability to borrow, grow a business, or follow the American Dream. This resolution assures that Warren County’s investments and contracts, to the extent that the law allows, will be based on actual performance and not some arbitrary ‘woke’ rating. I am proud to be the first New Jersey government entity to pass this kind of anti-ESG resolution.”

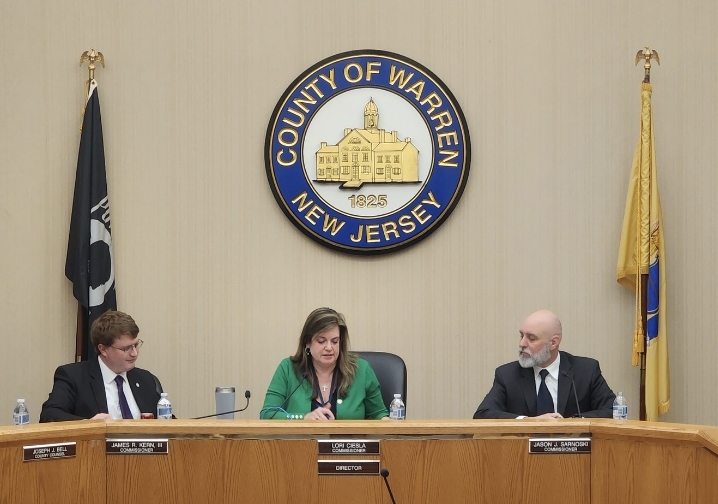

Commissioner Director Lori Ciesla gives her comments on the resolution opposing ESG standards, as Commissioner James R. Kern III (left) and Commissioner Jason J. Sarnoski listen. The board unanimously approved a resolution critical of using ESG to guide public investments.