(WHITE TOWNSHIP, NJ – March 22, 2023) – A 2023 spending plan that decreases the equalized tax rate to the lowest level in more than a decade, and that fully funds a capital improvement program with no borrowing, won unanimous approval from the Warren County Board of County Commissioners tonight.

The $106 million county government budget, along with the $6.1 million county library budget, were the result of careful planning and hard decisions, the commissioners said.

“I think we are the epitome of fiscal responsibility,” Commissioner Director Lori Ciesla said, explaining when it comes to tax dollars, “We look at it as your money, and make sure we spend it wisely and make sure you get the most out of it.”

Ciesla noted there were “tough decision made in the past by previous boards” that put Warren County on a solid financial footing, so that in spite of inflation, the commissioners could deliver a budget that results in a decrease in the equalized tax rate of 4.5 cents per $100 of property. A library budget will result in a half-cent decrease in the equalized rate, for an overall decrease of 5 cents per $100 on the combined rate.

A “very good year with ratables” helped produce the tax rate decrease, county Chief Financial Officer Kim Francisco said, noting Warren County saw an increase in the tax base – the amount and value of taxable property – of more than 10 percent.

Commissioner Jason J. Sarnoski said he was proud that the ratables were up significantly, explaining, “That just shows you, people want to be in Warren County. They want to live here, they want to raise families here, they want to work here, and they want their businesses here, because we provide a safe county, we provide a beautiful county with a lot of open space.”

The commissioners are giving that growth in ratables back to the taxpayers by decreasing the equalized tax rate, Sarnoski said, noting that for someone owning a $300,000 home, “That’s $150 a year in tax savings. That’s significant.”

Sarnoski said that in 2010, the year before he took office, overall county spending – which included the library and open space budgets – was $126 million, compared with $113 million now. Warren County is spending about 10 percent less now than it did 13 years ago, he noted.

“This board recognizes that what we ask for from our residents is sacred, that’s their earned money. They have the right to it. We only use what we think we need,” Sarnoski said.

Commissioner James R. Kern III remarked that while the board establishes the fiscal policies, “What’s really important about this budget is the work and the ask that we put on our county departments.” In a time of record inflation, the commissioners asked county departments to do more with less.

Kern explained, “We don’t make it easy for our departments, but that’s because we are charged with protecting the taxpayers’ money … and making sure it’s well-used.”

Kern said he believes Warren County provides “exceptional service” for the public’s tax dollars, while Sarnoski said it was “really great work by our whole team” that produced the spending plan.

The county budget includes $15.7 million in capital spending. “It’s fully funded, there will be no borrowing for any of these projects,” Francisco said, pointing to the county’s long-standing “pay-as-you-go” policy.

The capital projects include:

- $1.2 million in road improvements

- $1.2 million in bridge improvements

- $1.18 million for equipment, including $200,000 for voting machine replacements and $500,00 for technology upgrades in the Public Safety Department

- $500,000 to assist Warren County Technical School with capital projects

- $6.97 million for a project to renovation the Catherine Dickson Hofman Branch of the county library system, including moving and storage

- $1.14 million for a new Human Services and Temporary Assistance and Social Services building.

Francisco explained that with inflation, “A lot of things went up a little, and a few things went up a lot.” Pension costs increased $495,000 and heath care for prisoners at the Warren County Correctional Center rose $367,000.

But county debt payments continue to decrease – the result of the policy against borrowing – and employee health insurance, despite dramatic increases for state government and other county and municipal governments, stayed flat. Francisco noted that Warren County left the state health insurance plan two years ago and is self-insured, and “running a good program.” Costs are up an average of 19 percent around the state, which would have had a large impact had Warren still been in the state plan, Francisco said, as employee health insurance at $14 million is the single biggest line item in the budget.

The budget and the resulting tax decrease, Sarnoski said, is “not a gimmick. This is sustainable.” The county has been able to do this “because we’re budgeting wisely,” he said.

The county budget is available online for public review.

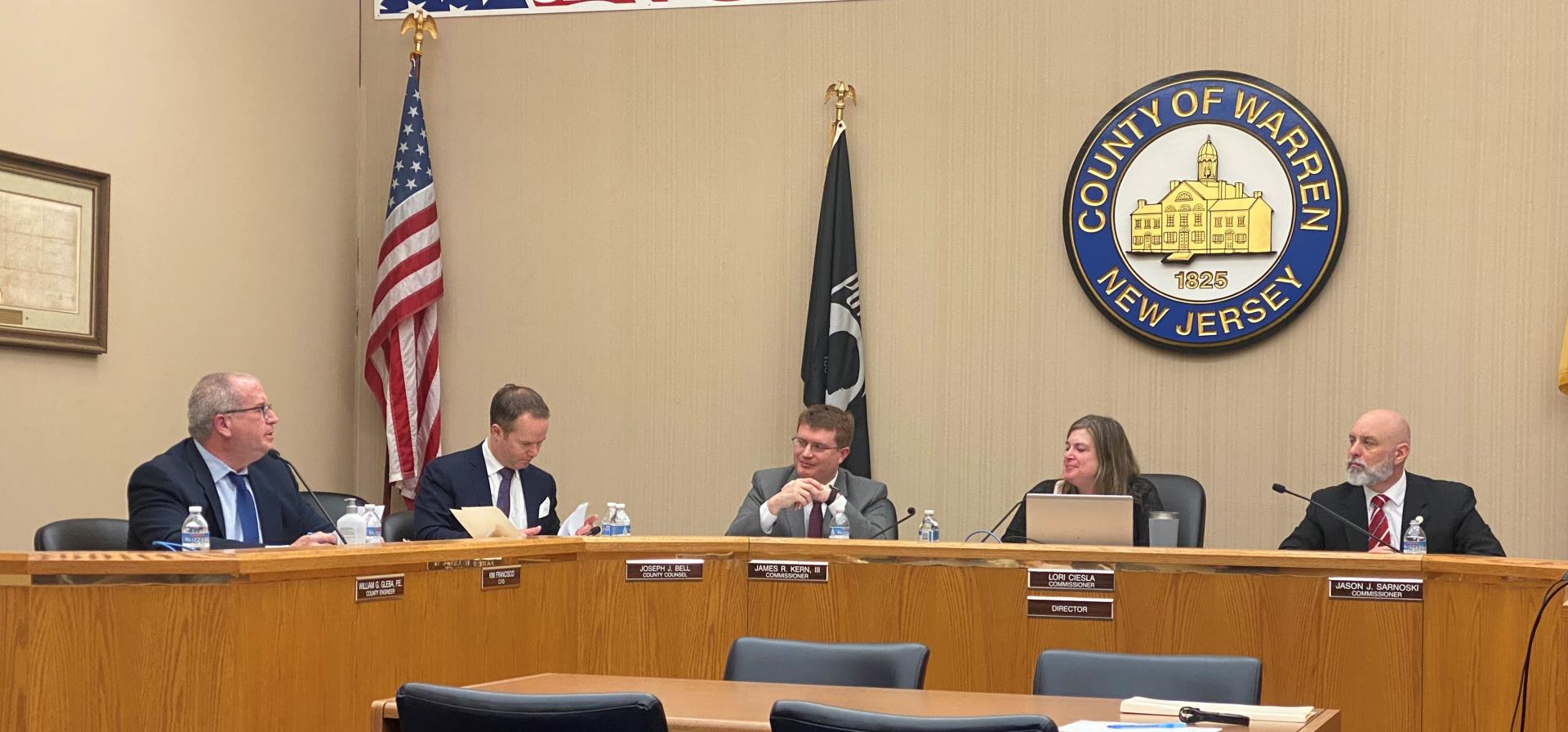

Warren County Chief Financial Officer Kim Francisco (left) discusses the county’s 2023 budget before the final votes to adopt the spending plan with (l-r) county Counsel Joseph J. Bell IV, Commissioner James R. Kern III, Commissioner Director Lori Ciesla, and Commissioner Jason J. Sarnoski.